If necessary, you may include additional categories that are relevant to your business. You may also wish to break down your business’ COA according to product line, company division, or business function, depending on your unique needs. Assets play an essential role in a chart of accounts as they represent the resources a company owns or controls that are expected to provide future benefits. In a chart of accounts, assets are usually classified into current or non-current categories.

Revenue Accounts

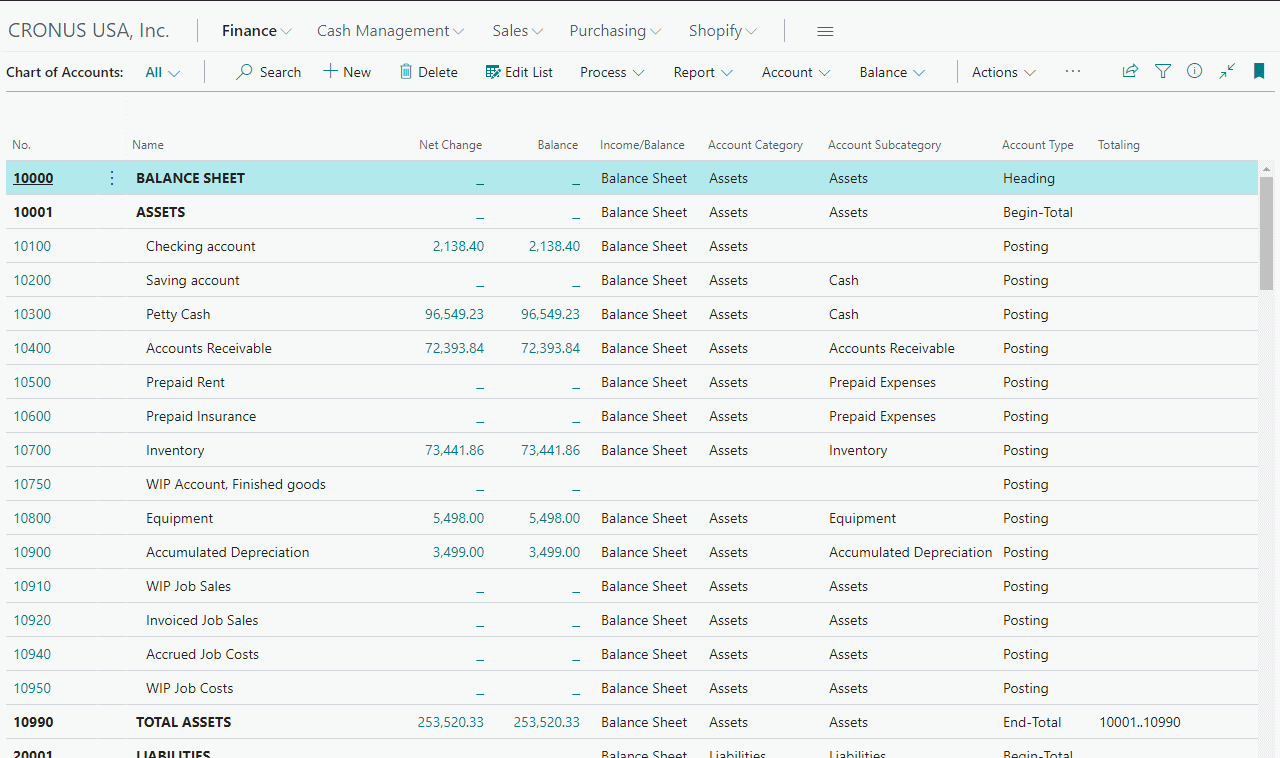

Accounts in a COA are typically listed in the order by which they appear in the financial statements. Its length will naturally depend on the company’s size, with larger companies having a larger and more complex chart of accounts compared to smaller companies. Since it is a flexible financial organization tool, there is no standard length of a chart of accounts. Now, the trial balance (the summary of all account balances) checking account balance reflects $125,453 at the end of May which is included in the financial statements. Next, I’ll show you how the chart of accounts is a part of the financial statement building process. Below, I explain what a chart of accounts is and how you will use it in bookkeeping and accounting.

Download Chart of Accounts Example Template (Excel included)

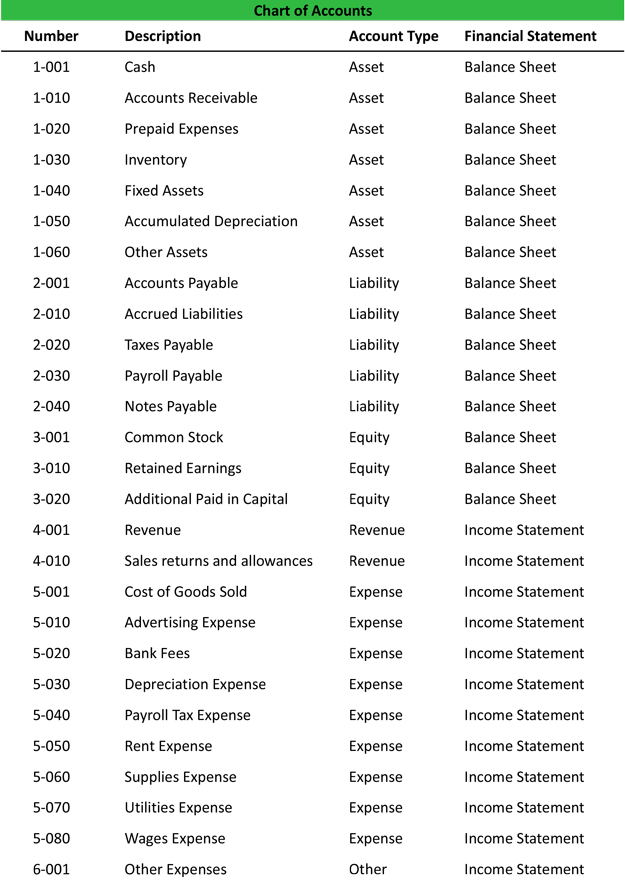

While the chart of accounts can be similar across businesses in similar industries, you should create a chart of accounts that is unique to your individual business. You should ask yourself, what do I want to track in my business and how do I want to organize this information? For example, we often suggest our clients break down their sales by revenue stream rather than just lumping all sales in a Revenue category. By doing so, you can easily understand what products or services are generating the most revenue in your business. If you create too many categories in your chart of account, you can make your entire financial reports difficult to read and analyze.

Chart of Accounts: Definition, Guide and Examples

The Chart of Accounts is one of those unknown parts of your accounting software we don’t even think about. In this ultimate guide, not only do we explore examples of a common chart of accounts but also we discuss best practices on how to properly set up your chart of accounts. Each account in the chart of accounts is typically assigned a name and a unique number by which it can be identified.

Example: Standard Chart of Accounts List

A diagram depicting a company’s hierarchy or chain of command, its business segments, functions, and departments. Find out more about how QuickBooks Online can help you save time and stay on top of your finances while you grow your business. As time goes by, you may find yourself wanting to create a new line item for each transaction, but doing so could litter your company’s chart and make it difficult to navigate. Make sure that your line items have titles that make sense to you and your accountant, so use straightforward titles like ‘bank fees’, or ‘bottling equipment’. Marshall Hargrave is a financial writer with over 15 years of expertise spanning the finance and investing fields. He has experience as an editor for Investopedia and has worked with the likes of the Consumer Bankers Association and National Venture Capital Association.

- This is crucial for providing investors and other stakeholders a bird’s-eye view of a company’s financial data.

- The best way to think of an asset is as something that might in future generate cash flow for the company, reduce its expenses, or increase sales.

- In some cases, especially for bigger companies with a more complex chart of accounts, the account code might be represented by 4 digits.

- Owner’s equity is the funds owners inject into the business to finance its operations.

Nevertheless, the exact structure of the chart of accounts is the reflection on the individual needs of each entity. Essentially, if you placed the statements of financial position and performance on top of each other, you would come up with the chart of accounts. To ensure an efficient COA structure, it is crucial to establish a consistent a chart of accounts usually starts with and standardized coding system for account numbering and naming conventions. This will enhance the readability and usability of financial reports across all departments and divisions. This way you can compare the performance of different accounts over time, providing valuable insight into how you are managing your business’s finances.

Most new owners start with one or two broad categories, like sales and services, it may make sense to create seperate line items in your chart of accounts for different types of income. This is because while some types of income are easy and cheap to generate, others require considerable effort, time, and expense. In addition, the operating revenues and operating expenses accounts might be further organized by business function and/or by company divisions. A chart of accounts (COA) is an index of all of the financial accounts in a company’s general ledger.

It is important to keep track of both common and preferred stock in the equity accounts, as they have different implications for the company’s financial management and shareholder rights. Thanks to accounting software, chances are you won’t have to create a chart of accounts from scratch. Accounting software products generally set you up with a basic chart of accounts that you can work with your accountant or bookkeeper to amend, according to your industry and your business’s complexity. Though most accounting software products set you up with a standard COA or let you import your own, it’s a good idea to have an accountant scan it and add any other accounts that are specific to your business. A company’s organization chart can serve as the outline for its accounting chart of accounts. Each department will have its own phone expense account, its own salaries expense, etc.

What’s important is to use the same format over time for the consistency of period-to-period and year-to-year comparisons. However, they also must respect the guidelines set out by the Financial Accounting Standards Board (FASB) and generally accepted accounting principles (GAAP). Identifying which locations, events, items, or services bring in the most cash flow is key to better financial management. Use that information to allocate resources to more profitable parts of your business and cuts costs in areas that are lagging. Accounting systems have a general ledger where you record your accounts to help balance your books. Keeping your accounts in place and up-to-date is important for analyzing your finances.

QuickBooks Online automatically sets up a chart of accounts for you based on your business, with the option to customise it as needed. Your chart of accounts is a living document for your business, meaning, over time, accounts will inevitably need to be added or removed. The general rule for adding or removing accounts is to add accounts as they come in, but wait until the end of the year or quarter to remove any old accounts.

Integrating your Chart of Accounts (COA) with accounting software is crucial for streamlining financial management processes. Setting up a COA in software like QuickBooks Online involves creating a list of categories to distinguish financial transactions. These categories typically include assets, liabilities, shareholder’s equity for the balance sheet, and revenue and expenses for the income statement. A chart of accounts is a tool used to categorize and organize all the financial transactions in a company’s accounting system.

0 Comments

Leave a reply

You must be logged in to post a comment.